Tax Rate Toronto Canada . The ontario tax brackets and personal tax credit amounts are increased for 2024 by an indexation. the tax rates in ontario range from 5.05% to 13.16% of income and the combined federal and provincial tax rate is between 20.05%. our income tax calculator for individuals works out your personal tax bill and marginal tax rates, no matter where you reside in. This results in an effective tax rate of 25%, as. forbes advisor canada has a tool to help you figure it out. If you make $60,000 a year living in ontario you will be taxed $11,847. 16 rows ontario 2024 and 2023 tax rates & tax brackets. 61 rows your tax rate will vary by how much income you declare at the end of the year on your t1 general income tax return and where you live in canada.

from www.mdd.com

16 rows ontario 2024 and 2023 tax rates & tax brackets. This results in an effective tax rate of 25%, as. our income tax calculator for individuals works out your personal tax bill and marginal tax rates, no matter where you reside in. the tax rates in ontario range from 5.05% to 13.16% of income and the combined federal and provincial tax rate is between 20.05%. forbes advisor canada has a tool to help you figure it out. If you make $60,000 a year living in ontario you will be taxed $11,847. 61 rows your tax rate will vary by how much income you declare at the end of the year on your t1 general income tax return and where you live in canada. The ontario tax brackets and personal tax credit amounts are increased for 2024 by an indexation.

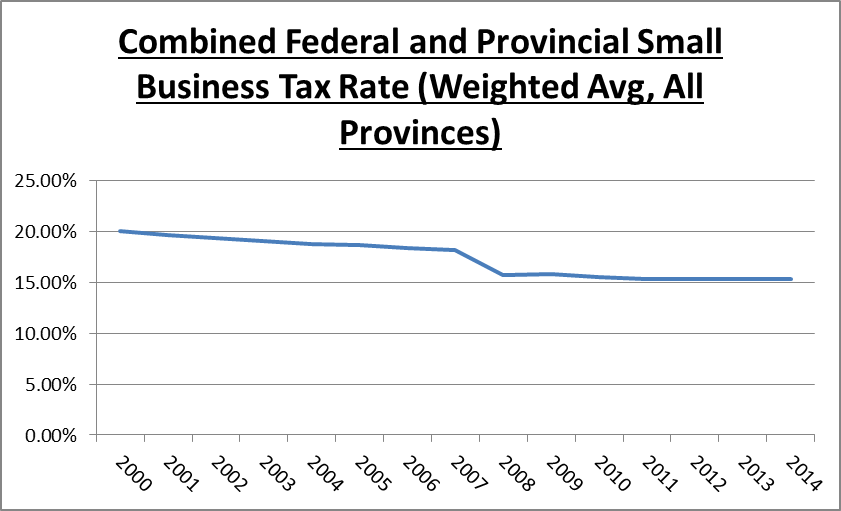

Tax Rates, Timing and Damages in Canada

Tax Rate Toronto Canada The ontario tax brackets and personal tax credit amounts are increased for 2024 by an indexation. 61 rows your tax rate will vary by how much income you declare at the end of the year on your t1 general income tax return and where you live in canada. forbes advisor canada has a tool to help you figure it out. This results in an effective tax rate of 25%, as. 16 rows ontario 2024 and 2023 tax rates & tax brackets. our income tax calculator for individuals works out your personal tax bill and marginal tax rates, no matter where you reside in. The ontario tax brackets and personal tax credit amounts are increased for 2024 by an indexation. the tax rates in ontario range from 5.05% to 13.16% of income and the combined federal and provincial tax rate is between 20.05%. If you make $60,000 a year living in ontario you will be taxed $11,847.

From cardinalpointwealth.com

Winter 2021 Canadian Tax Highlights Cardinal Point Wealth Management Tax Rate Toronto Canada This results in an effective tax rate of 25%, as. If you make $60,000 a year living in ontario you will be taxed $11,847. 16 rows ontario 2024 and 2023 tax rates & tax brackets. The ontario tax brackets and personal tax credit amounts are increased for 2024 by an indexation. the tax rates in ontario range from. Tax Rate Toronto Canada.

From reviewsandbuyingguide.com

Toronto tax rates Reviews And Buying Guide Tax Rate Toronto Canada forbes advisor canada has a tool to help you figure it out. our income tax calculator for individuals works out your personal tax bill and marginal tax rates, no matter where you reside in. If you make $60,000 a year living in ontario you will be taxed $11,847. The ontario tax brackets and personal tax credit amounts are. Tax Rate Toronto Canada.

From www.zoocasa.com

Ontario Cities With the Highest and Lowest Property Tax Rates in 2022 Tax Rate Toronto Canada our income tax calculator for individuals works out your personal tax bill and marginal tax rates, no matter where you reside in. 61 rows your tax rate will vary by how much income you declare at the end of the year on your t1 general income tax return and where you live in canada. 16 rows ontario. Tax Rate Toronto Canada.

From storeys.com

Here's How Toronto's Property Tax Rates Compare to Other Ontario Cities Tax Rate Toronto Canada our income tax calculator for individuals works out your personal tax bill and marginal tax rates, no matter where you reside in. 16 rows ontario 2024 and 2023 tax rates & tax brackets. the tax rates in ontario range from 5.05% to 13.16% of income and the combined federal and provincial tax rate is between 20.05%. The. Tax Rate Toronto Canada.

From www.crowe.com

Canadian Sales Tax Registration Requirements Crowe Soberman LLP Tax Rate Toronto Canada forbes advisor canada has a tool to help you figure it out. 16 rows ontario 2024 and 2023 tax rates & tax brackets. 61 rows your tax rate will vary by how much income you declare at the end of the year on your t1 general income tax return and where you live in canada. our. Tax Rate Toronto Canada.

From toronto.ctvnews.ca

GTA residents say Toronto taxpayers shouldn't complain proposed rate hike CTV News Tax Rate Toronto Canada The ontario tax brackets and personal tax credit amounts are increased for 2024 by an indexation. our income tax calculator for individuals works out your personal tax bill and marginal tax rates, no matter where you reside in. 16 rows ontario 2024 and 2023 tax rates & tax brackets. the tax rates in ontario range from 5.05%. Tax Rate Toronto Canada.

From storeys.com

Budget 2020 What the Average Toronto Property Tax Increase Will Be Tax Rate Toronto Canada 61 rows your tax rate will vary by how much income you declare at the end of the year on your t1 general income tax return and where you live in canada. 16 rows ontario 2024 and 2023 tax rates & tax brackets. our income tax calculator for individuals works out your personal tax bill and marginal. Tax Rate Toronto Canada.

From www.fraserinstitute.org

Fraser Institute Tax Rate Toronto Canada 16 rows ontario 2024 and 2023 tax rates & tax brackets. 61 rows your tax rate will vary by how much income you declare at the end of the year on your t1 general income tax return and where you live in canada. the tax rates in ontario range from 5.05% to 13.16% of income and the. Tax Rate Toronto Canada.

From www.investmentexecutive.com

earners need specialized advice Investment Executive Tax Rate Toronto Canada This results in an effective tax rate of 25%, as. If you make $60,000 a year living in ontario you will be taxed $11,847. The ontario tax brackets and personal tax credit amounts are increased for 2024 by an indexation. 16 rows ontario 2024 and 2023 tax rates & tax brackets. our income tax calculator for individuals works. Tax Rate Toronto Canada.

From www.blogto.com

This is where Toronto ranks vs other Ontario cities for property taxes Tax Rate Toronto Canada If you make $60,000 a year living in ontario you will be taxed $11,847. 61 rows your tax rate will vary by how much income you declare at the end of the year on your t1 general income tax return and where you live in canada. 16 rows ontario 2024 and 2023 tax rates & tax brackets. . Tax Rate Toronto Canada.

From www.todocanada.ca

Pay 2999 in Toronto and 8878 in Windsor for a 500K House 2020 Property Tax Rates in Ontario Tax Rate Toronto Canada 16 rows ontario 2024 and 2023 tax rates & tax brackets. The ontario tax brackets and personal tax credit amounts are increased for 2024 by an indexation. forbes advisor canada has a tool to help you figure it out. 61 rows your tax rate will vary by how much income you declare at the end of the. Tax Rate Toronto Canada.

From www.fraserinstitute.org

Fraser Tax Rate Toronto Canada 61 rows your tax rate will vary by how much income you declare at the end of the year on your t1 general income tax return and where you live in canada. the tax rates in ontario range from 5.05% to 13.16% of income and the combined federal and provincial tax rate is between 20.05%. our income. Tax Rate Toronto Canada.

From breezecustoms.com

Ultimate Guide on How to Import into Canada Breeze Customs Tax Rate Toronto Canada The ontario tax brackets and personal tax credit amounts are increased for 2024 by an indexation. 16 rows ontario 2024 and 2023 tax rates & tax brackets. If you make $60,000 a year living in ontario you will be taxed $11,847. forbes advisor canada has a tool to help you figure it out. This results in an effective. Tax Rate Toronto Canada.

From www.toronto.ca

Budget Basics City of Toronto Tax Rate Toronto Canada the tax rates in ontario range from 5.05% to 13.16% of income and the combined federal and provincial tax rate is between 20.05%. This results in an effective tax rate of 25%, as. our income tax calculator for individuals works out your personal tax bill and marginal tax rates, no matter where you reside in. If you make. Tax Rate Toronto Canada.

From www.cbc.ca

Toronto has room to hike property taxes by 20 to fund city services, researchers say CBC News Tax Rate Toronto Canada If you make $60,000 a year living in ontario you will be taxed $11,847. our income tax calculator for individuals works out your personal tax bill and marginal tax rates, no matter where you reside in. The ontario tax brackets and personal tax credit amounts are increased for 2024 by an indexation. forbes advisor canada has a tool. Tax Rate Toronto Canada.

From www.fraserinstitute.org

Fraser Tax Rate Toronto Canada The ontario tax brackets and personal tax credit amounts are increased for 2024 by an indexation. If you make $60,000 a year living in ontario you will be taxed $11,847. our income tax calculator for individuals works out your personal tax bill and marginal tax rates, no matter where you reside in. This results in an effective tax rate. Tax Rate Toronto Canada.

From canadiantaxrefunds.ca

A guide to the complications of the Toronto tax rates Canadian Tax Refunds Tax Rate Toronto Canada If you make $60,000 a year living in ontario you will be taxed $11,847. 16 rows ontario 2024 and 2023 tax rates & tax brackets. our income tax calculator for individuals works out your personal tax bill and marginal tax rates, no matter where you reside in. forbes advisor canada has a tool to help you figure. Tax Rate Toronto Canada.

From www.gatewaytax.ca

Canadian Small Business Tax Rates A Simple 2023 Guide Tax Rate Toronto Canada The ontario tax brackets and personal tax credit amounts are increased for 2024 by an indexation. 61 rows your tax rate will vary by how much income you declare at the end of the year on your t1 general income tax return and where you live in canada. our income tax calculator for individuals works out your personal. Tax Rate Toronto Canada.